Every single writer and editor follows NerdWallet's rigid guidelines for editorial integrity to guarantee precision and fairness in our protection.

All businesses are exclusive and therefore are subject to acceptance and evaluate. The required FICO score could be better based upon your marriage with American Convey, credit record together with other aspects.

According to the 2023 Small Business Credit Study, business lines of credit are the preferred sort of funding used for, with 43 percent of businesses vying for one.

Wells Fargo’s secured line of credit is an efficient option for perfectly-established businesses that want access to significant quantities of working capital. This line of credit provides reduced curiosity fees along with a a single-calendar year repayment term that may be renewed per year.

Many small business authorities advise that first-time applicants should begin a modest line of credit and pay off the financial debt quickly like a way of building a credit profile.

Examining account guideBest examining accountsBest no cost checking accountsBest online Look at accountsChecking account solutions

Lenders generally check out the next to find out your eligibility for any business line of credit:

All over the lifestyle of your respective business you might have to secure outside the house funding. Understand conventional and substitute financing solutions that can help you realize your targets.

So how exactly does LendingTree Get Paid? LendingTree is compensated by companies on This great site and this payment might impact how and wherever presents look on This web site (such as the purchase). LendingTree will not include things like all lenders, price savings solutions, or loan possibilities accessible while in the Market.

Collateral is often an asset the lender can seize for those who default within the loan. For small businesses, belongings like equipment, dollars financial savings or real-estate can often function collateral for secured business loans.

Usually, the money are deposited on the exact same working day or inside a few business days. In comparison, an SBA or regular bank loan is more time intensive, with funding times lasting around 90 times.

While SBA microloans only present nearly $50,000, they supply aggressive curiosity costs and repayment conditions. They also have flexible eligibility specifications — building them a fantastic choice for borrowers who will’t qualify for other business loans.

Financial institution of America, Merrill, their affiliate marketers and advisors do not present authorized, tax or accounting advice. Talk to your own lawful and/or tax advisors prior to making any fiscal selections. Any informational components presented are for your personal discussion or overview needs only. The content on the Center for Business Empowerment (which includes, without constraints, third party and any copyright content) is delivered “as is” and carries no Specific or implied warranties, or assure or guaranty of achievements.

In depth money projections are essential for how to obtain financing for a small business demonstrating your business’s economic health and talent to repay the small business loan. Involve:

Val Kilmer Then & Now!

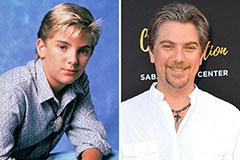

Val Kilmer Then & Now! Jeremy Miller Then & Now!

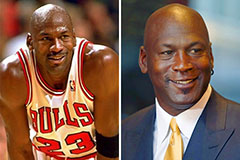

Jeremy Miller Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!